Get the client-facing version here for less than $20

By Denise Appleby MJ, APA, AKA, CISP, CRC, CRPS, CRSP

The backdoor Roth IRA contribution circumvents the income limits for regular Roth IRA contributions.

Many tax and financial experts believe that income tax rates will increase. For this reason, a Roth IRA is considered a better choice than a traditional IRA if the objective is a lower income tax bracket. But what if an individual is not eligible to make a regular contribution to a Roth IRA because their income is too high? They can get around this limitation using the backdoor Roth IRA contribution strategy.

Why Roth IRAs are Attractive

Like traditional IRAs, Roth IRA earnings grow tax-deferred. But unlike traditional IRAs, where distributions of earnings are subject to ordinary income taxes, distributions of earnings from a Roth IRA are tax-free as long as the distribution is qualified.

A Roth IRA distribution will be qualified if the following two requirements are met:

- The distribution is made five or more years after the owner funded their first Roth IRA. and,

- The distribution is made when the owner is at least age 59½, disabled, or a first-time homebuyer, in which case the amount is limited to $10,000 over your lifetime.

Of course, like any other financial planning strategy, a Roth IRA is not a one-size-fits-all solution. Therefore, a suitability assessment will determine if the Roth IRA is the right choice for your client. If a Roth IRA is suitable for a client whose income prohibits a direct contribution, the following path to a Roth IRA can be used.

The Income Limitation on Roth IRA Contributions

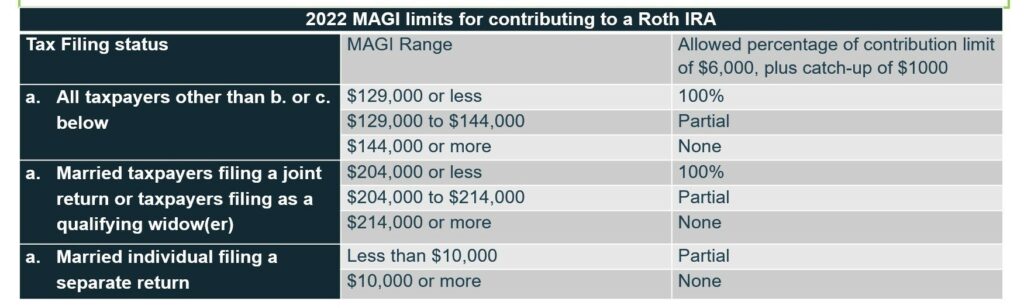

A Roth IRA can be funded by making regular IRA contributions. Unlike traditional IRAs, which are not subject to income limits, an individual is eligible to make a regular contribution to a Roth IRA only if their modified adjusted gross income (MAGI) does not exceed the following amounts:

2022 MAGI Limits

- $144,000 or more, if their tax filing status is Single

- $214,000 or more, if their tax filing status is Married Filing Jointly

- $10,000, if their tax filing status is Married Filing Separately

See table for full range

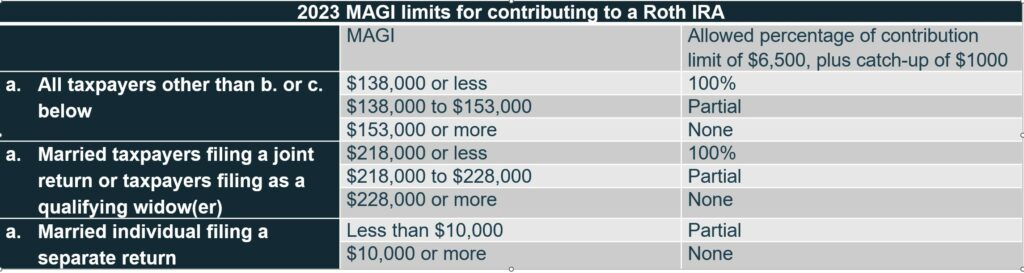

2023 MAGI Limits

- $153,000 or more if their tax filing status is Single.

- $228,000 or more, if their tax filing status is Married Filing Jointly

- $10,000, if their filing status is Married Filing Separately

See table for full range

But this limitation can be circumvented using a strategy commonly referred to as a backdoor Roth IRA contribution.

The Two Steps to a Backdoor Roth IRA Contribution

The backdoor Roth IRA contribution is a strategy, not a product or type of IRA contribution. Therefore, one should not ask for it by name. Instead, the following steps should be taken:

Step 1: Make the Contribution to a Traditional IRA

Reminder: An individual can make a regular contribution to a traditional IRA only if they have eligible compensation for the year. Examples of eligible compensation include wages and self-employment income.

A regular IRA contribution cannot exceed the lesser of:

- $6,000 for 2022/ $6,500 for 2023 or,

- 100% of your eligible compensation received for the contribution year.

If the individual is at least age 50 by the end of the year, they are eligible to make an additional catch-up contribution of $1,000.

Reminder: An IRA contribution must be made by the individual’s tax filing due date. Generally, extensions do not apply.

Tip: Reporting Nondeductible Traditional IRA Contributions

If an individual or their spouse – if married – are not covered under an employer-sponsored retirement plan such as a 401(k) or defined benefit pension plan for the contribution year, they are eligible to claim a tax deduction for their traditional IRA contribution. However, for those covered under an employer plan, eligibility to claim a deduction for the contribution depends upon their MAGI.

An individual’s tax advisor will determine if they can claim a tax deduction for their traditional IRA contribution and, if so, whether they should claim that deduction.

If no deduction is claimed for the traditional IRA contribution, IRS Form 8606 should be filed to report and track the amount so that any distribution or Roth conversion of the nondeductible amount is nontaxable.

Step 2: Convert the Contribution to a Roth IRA

The IRA owner should instruct the IRA Custodian/Trustee to convert the traditional IRA contribution to a Roth IRA. This conversion will result in the amount being moved to the Roth IRA, technically resulting in a Roth IRA contribution, albeit through a “back door.”

If the individual has a basis in their traditional IRA, whether from any nondeductible traditional IRA contributions or a rollover of after-tax amounts from an employer plan, the Roth conversion will include a pro-rated amount of this basis and pre-tax balances. Only the pre-tax amount would be taxable. An individual’s traditional IRAs, SEP IRAs, and SIMPLE IRAs are treated as one traditional IRA.

If there is no basis, then the Roth IRA conversion will include only the pre-tax amount and, therefore, be fully taxable.

The IRA custodian/trustee will report the Roth conversion as fully taxable even if a portion of the amount is attributed to the basis and should be tax-free. This tax reporting is because they have no way of knowing how much is attributed to basis amounts. However, as the individual’s tax preparer, you must file IRS Form 8606 to let the IRS know how much of the conversion includes the basis.

Additional Tips

Remind clients that they are ultimately responsible for keeping track of their Roth IRA activity, including the onset of their 5-year period for a qualified Roth distribution. A financial institution can track the 5-year period on its platform, but such tracking does not carry over if the Roth IRA is moved to another financial institution. Failing to keep track of the 5-year period could result in the Roth IRA owner paying income tax and a 10% early distribution penalty on distributions that otherwise should be tax-free.

Sources of funding – regular contributions, Roth conversions, and earnings – should also be tracked. If a distribution is nonqualified, tracking these amounts should help to determine how much is nontaxable.

Finally, if a client is of the age at which they should take required minimum distributions (RMDs), any RMD due must be taken before the Roth conversion.